The second quarter of 2025 has been one of the most eventful in recent memory. From a flurry of headlines surrounding global tariffs, the Department of Government Efficiency (DOGE) and The One, Big, Beautiful Bill, to rising geopolitical tensions, markets had plenty of reasons to be concerned. Yet, the stock market-as measured by the S&P 500- largely shrugged off these concerns and approached a near-record high.

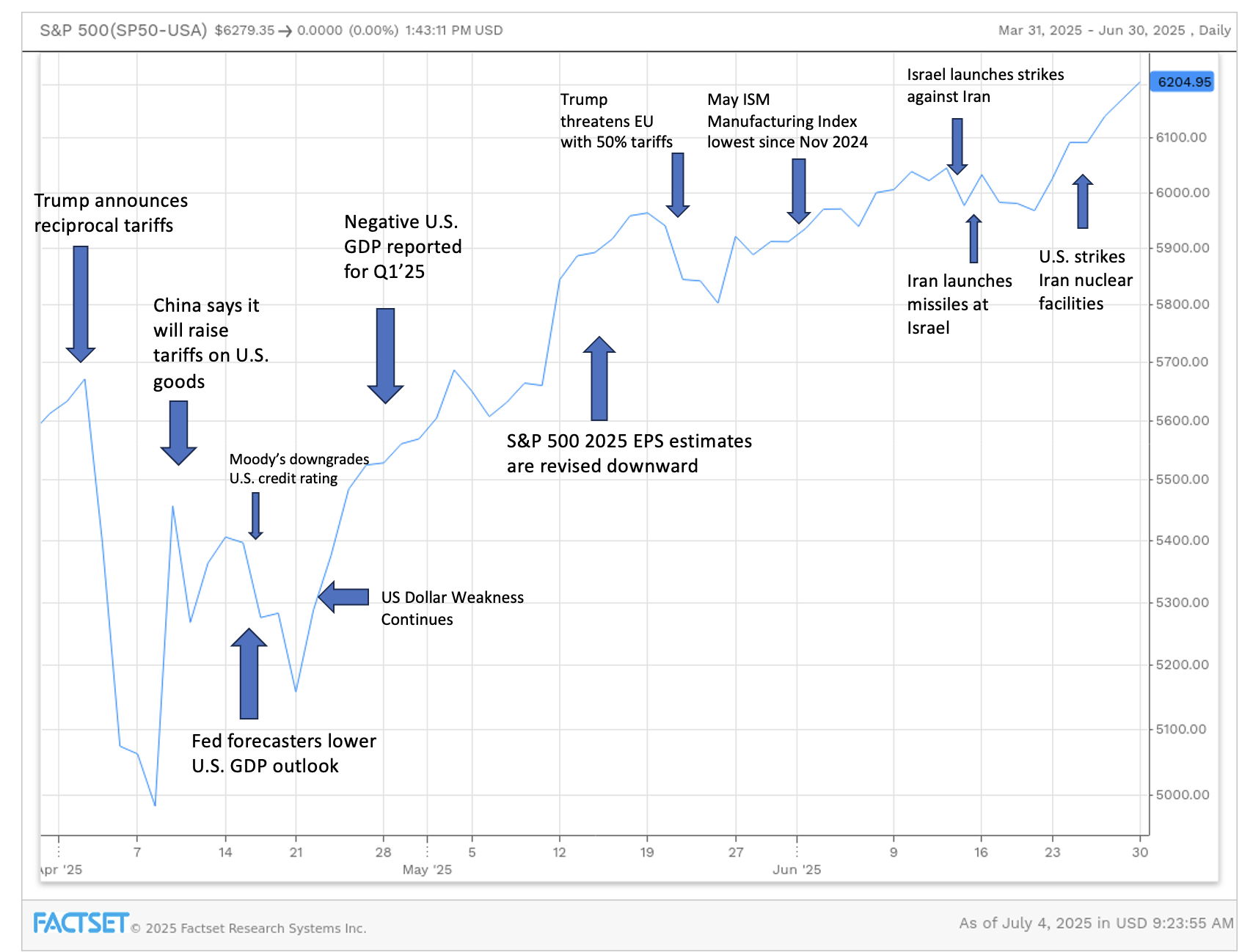

In fact, the S&P 500 posted its strongest quarterly performance since 2023, returning 10.9% after a 4.3% decline in Q1’25. This was a market that climbed “A Wall of Worry” where stock prices continue to rise despite economic uncertainty or negative news headlines. This market performance can be depicted from the S&P 500 Q2’25 stock price chart along with some of the challenging news events:

Despite the rebound in U.S. stocks, international stocks remain well ahead for the year. The MSCI EAFE Index, in US Dollar terms, is up nearly 20% year to date. Contributing factors included more attractive valuations abroad, U.S. policy uncertainty, and a weaker US Dollar- all of which boosted the relative performance of international markets.

U.S. bonds, as measured by Bloomberg U.S. Aggregate Index, have also delivered solid returns- up 4% year to date versus 1.3% all of last year. U.S. Corporate bond spreads remain tight, and do not appear to be pricing in significant economic concerns.

Market Outlook

Looking ahead, investors and the Federal Reserve will closely watch the potential inflationary impact of tariffs in the second half of 2025. The pace of inflation will likely impact when the Fed will begin to cut short term rates with markets anticipating a total of 50 bps point rate cut this year.

Additionally, the upcoming release of June-quarter corporate earnings, expected to begin later this week, will likely play a key role in the short-term market direction.

We will continue to monitor market developments while maintaining diversified portfolios that balance risk and return for our clients.

Sources: FactSet, Morningstar, Barron’s, The Wall Street Journal, JP Morgan “Guide to the Markets 3Q 2025”

Disclosures: CJ Perry Financial is a Registered Investment Adviser in the state of Pennsylvania. Advisory services are only offered to clients or prospective clients where CJ Perry Financial and its representatives are properly registered or exempt from registration. "Likes" should not be considered a positive reflection of the investment advisory services offered by CJ Perry Financial.

Christopher Perry is an investment adviser representative of CJ Perry Financial. The firm is a registered investment adviser and only conducts business in jurisdictions where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

The information presented on this post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Comments should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell the investments mentioned. A professional adviser should be consulted before implementing any of the strategies discussed. Investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client's portfolio. All investment strategies can result in profit or loss.