We have two primary advisory service offerings:

Wealth Management Services

- Includes Investment Management Services and Comprehensive Financial Planning.

Project-Based Financial Planning

- As a one-time engagement. Here we assess aspects of your financial life, determine goals, and provide you with a financial plan to address those goals.

As part of our Wealth Management offering, Investment Management Services includes appropriate asset allocation, security selection, rebalancing, tax considerations, and ongoing maintenance. Regarding security selection, we primarily advise our clients regarding investments in stocks, bonds, mutual funds, ETFs, U.S. government and municipal securities, as well as cash and cash equivalents.

Comprehensive Financial Planning involves helping you identify your financial and life goals and developing a plan to address those goals. This may include cash flow analysis, debt management and budgeting, Social Security claiming strategies, health care planning, estate and tax management, risk management, and retirement transitioning.

Fees:

Wealth Management Services

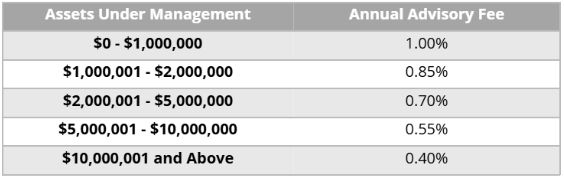

This fee is based on your percentage of assets under management.1 Our minimum annual fee for Wealth Management Services is $1,500. Our annualized fees for Wealth Management Services are based on the following fee schedule:

Project-Based Financial Planning

We charge a fixed fee for Project-Based Financial Planning. Fixed fee rates range from $500 to $5,000. The fee range is dependent upon variables including the specific needs of the Client, complexity, estimated time, research, and resources required to provide services to you, among other factors we deem relevant.

1 Fees are negotiable.